estate tax unified credit amount 2021

Then there is the exemption for gifts and estate taxes. In addition any portion of the unified credit that is unused can be used as an amount to be passed to a surviving spouse.

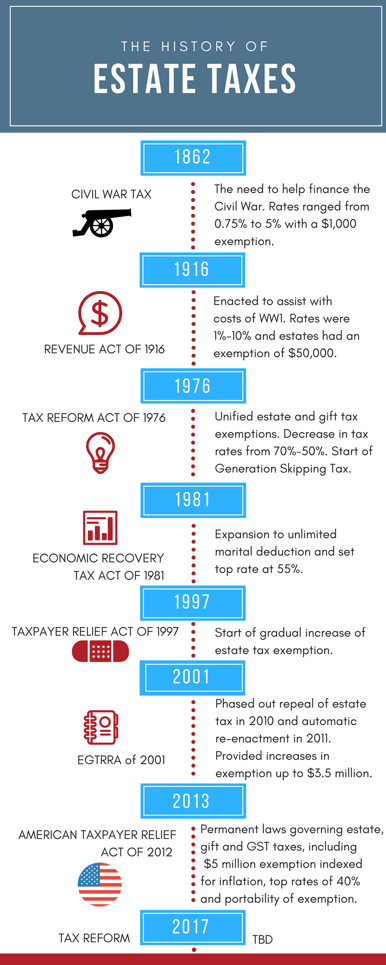

A Brief History Of Estate Gift Taxes

2020-45 which sets forth inflation-adjusted items for 2021 or various provisions of the Internal Revenue Code.

. This tax applies to the combined amount of money you give away during your lifetime and at your death. The 2022 exemption is 1206 million up from 117 million in 2021. With the passage of the Tax Cuts and Jobs Act.

For 2021 that lifetime exemption amount is 117 million. The unified tax credit changes regularly depending on regulations related to estate and gift taxes. Your estate wouldnt be subject to the federal estate tax at all if its worth 12059 million or less and you were to die in 2022.

The gift and estate tax exemptions were doubled in 2017 so the unified credit currently sits at 117 million per person. Highest tax rate for gifts or estates over the exemption amount Gift and estate exemption 2017 and prior years Gift and estate exemption 2022 expires in 2025 40. The tax is then reduced by the available unified credit.

This credit allows each person to gift a. This means that if the total amount you give. The unified credit exemption is an exemption from the estate and gift tax.

Generally when you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount. What Is the Unified Tax Credit Amount for 2021. While Congress can vote to make the 117 million exception permanent the Biden administration has pledged to drastically decrease the Unified Credit for Estate taxes from 117 million to.

Get information on how the estate tax may apply to your taxable estate at your death. The IRS announced new estate and gift tax limits for 2021. Right now the unified credit exemption is 11 million for single individuals and about 23 million for married couples.

Even then only the value over the exemption threshold is taxable. So if your estate does not surpass that threshold you will not face a federal estate tax when your spouse passes. The size of the estate tax exemption meant that a mere 01 of.

The unified aspect of this tax credit is that gift and estate taxes are rolled into one system to reduce your overall tax bill. The estate tax exemption is adjusted for inflation every year. January 1 2020 through December 31 2020.

Any tax due is determined after applying a credit based on an applicable exclusion amount. The basic exclusion amount for determining the unified credit against the estate tax will be 11700000 up from 11580000 for decedents dying in calendar year 2021. However if you intend to use the marital deduction your partners lifetime exemption is lost.

Instead as the law now exists there are more planning opportunities available for 2000. Oak Street Funding Well Get You There. A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure.

The unified tax credit applies to two or more different tax credits that apply to similar taxes. A key component of this exclusion is the basic exclusion amount BEA. The chart below shows the current tax rate and exemption levels for the gift and estate tax.

Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections. In short the unified tax credit sets a dollar amount that each person is able to gift during their lifetime before any estate or gift taxes kick in. For people who pass away in 2022 the exemption amount.

A person gives away 2000000 in their lifetime and dies in 2022 and is entitled to an individual federal estate tax exemption of 12060000. In the case of estate and gift taxes the unified tax credit provides a set amount that any individual can gift during their lifetime before any of these two taxes apply. 2021 through December 31 2021.

Or of course you can use the unified tax credit to do a little bit of both. The much discussed proposed changes to federal gift and estate taxes has not materialized for 2021. The amount of the nonresidents federal gross estate plus the amount of any includible gifts exceeds the basic exclusion amount.

After 2025 the exemption will revert to the 549 million exemption adjusted for inflation. In October 2020 the IRS released Rev. The estate and gift taxes for example have shared a unified rate schedule.

Under the 2010 Tax Relief Act the lifetime estate and gift tax basic exclusion amount was 5000000. Unified Tax Credit. A tax credit that is afforded to every man woman and child in America by the IRS.

The federal estate tax exemption for 2022 is 1206 million. The Internal Revenue Service announced today the official estate and gift tax limits for 2021. Gift and Estate Tax Exemptions The Unified Credit.

The estate and gift tax exemption is 117 million per individual up from 1158 million in. The estate of a New York State resident must file a New York State estate tax return if the following. For 2022 the annual gift tax exclusion amount the amount you can gift to a person without having to utilize the unified credit will rise to 16000person.

Is added to this number and the tax is computed. The 2022 exemption is 1206 million up from 117 million in 2021. The lifetime estate exclusion amount also sometimes called the estate tax exemption amount the applicable exclusion amount or the unified credit amount has been increased for inflation beginning January 1 2021.

As of 2021 estates that exceed 117 million for individuals and 234 million for married couples are subject to estate tax. The 117 million exception in 2021 is set to expire in 2025. It will then be taken as a credit against any estate tax owed.

The first 1206 million of your estate is therefore exempt from taxation. This is called the unified credit. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax.

Estate Tax Exemption Basic Exclusion Amount 11700000. Some items of interest from an estate planning perspective are the following.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Exploring The Estate Tax Part 2 Journal Of Accountancy

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Tax Exemption 2021 Amount Goes Up Union Bank

U S Estate Tax For Canadians Manulife Investment Management

New York Estate Tax Everything You Need To Know Smartasset

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

U S Estate Tax For Canadians Manulife Investment Management

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

How To Avoid Estate Taxes With A Trust

A Guide To Estate Taxes Mass Gov

U S Estate Tax For Canadians Manulife Investment Management

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)